Please note: This page may contain affiliate links. If you buy a product or service through such a link we earn a commission at no additional cost to you.

What is an LLC? How an LLC can help your startup? And what are the benefits and implications of forming an LLC? These are the common questions every entrepreneur is having today.

If you want to know the answers, don’t worry, we have got you covered.

So you came here to understand what an LLC is. You probably would have heard from a friend who started a new business and is talking about LLC as a haven. Well, for people who are starting new businesses, LLC is kind of a haven.

According to Internal Revenue Services, around 2,731,022 LLCs have filed their tax returns in 2019 which makes 55% of the small businesses and 12.4% of non-employers. A famous business formation company says that more than 90% of their customers choose to form LLCs while choosing business formation plans.

So you see LLC is a popular business model and running your business as an LLC is a wise decision.

Personal Suggestion:

If you think that you need a little assistance starting an LLC and you want things to go as you have planned, then hiring an online LLC service would be a wise decision.

Right now ZenBusiness is the ideal LLC service for anyone who is starting a business. It is quite affordable and you will get the best overall experience from an LLC service.

If you are looking for an experienced company, then Legalzoom is the best choice. Their price is quite high compared to ZenBusiness and doesn’t provide you with all the features but they are the most popular LLC service provider.

Both these LLC service providers will take care of all your paperwork and will allow you to do things that are more important to you.

So, what does an LLC means?

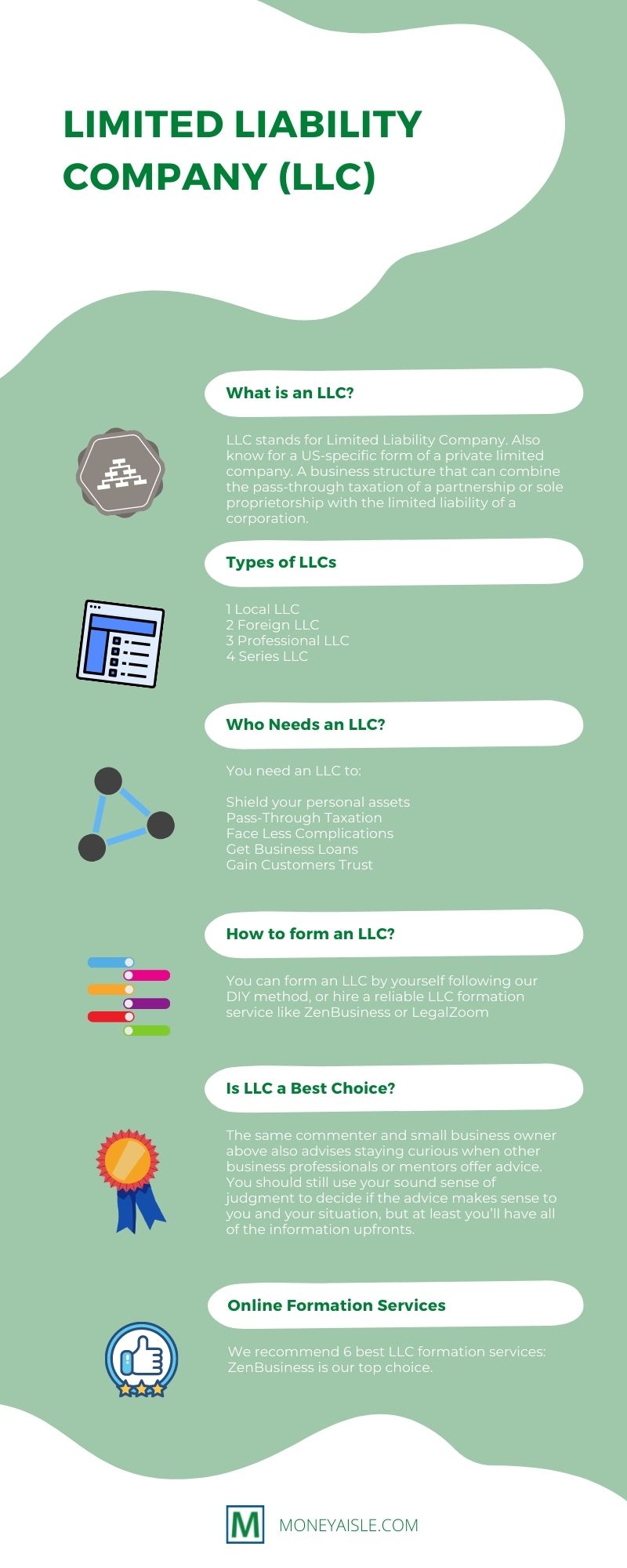

LLC stands for Limited Liability Company. Also, known for a US-specific form of a private limited company.

A business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

The main objective of this US business structure is to help business owners safeguard their personal assets from debts and lawsuits and it also strengthens the credibility of the business.

There can be one or multiple owners of LLCs. The owners are entitled as “LLC members“

It is true that LLC characteristics are similar to corporations but they are much cheaper and are quite easily formed.

LLC is just one of the types of business structures. Other examples include:

- Corporation

- Partnerships

- Sole Proprietorships

If you are starting a small business then choosing LLC is probably the best decision you are going to make. If you want to learn more about LLC, here we’ve compiled a detailed guideline on LLC formation.

The reason why I say corporations and sole proprietorships isn’t the right decision is because of the fact that, unlike DBA, LLC can safeguard your personal assets even if your business is sued and LLCs are not forced to double-taxation.

See Also: Learn the difference between LLC and DBA

Why Do You Need an LLC? Benefits, Features & Implications

Now you have got a general idea of LLC and its objectives. I am going to list down all the advantages, characteristics & implications that come with LLC.

Shielding your personal assets:

Anyone who is starting a new business is scared of all these lawsuits. For him or her, it would be appropriate if the company makes him feel secure.

By choosing LLC your personal assets won’t be affected even if your company is bounded with lawsuits and debts. Even if your company can not afford to pay these debts, you will never be forced to pay through your personal assets.

In simple words, if the situation goes worse your personal assets will never be put in question.

Pass-Through Taxation:

Here we will understand how taxes in LLCs work.

There are a total number of three main tax structures from which the owner chooses according to his requirements.

1) Single-member:

You can understand just by the name that this structure is taxed exactly how a sole proprietorship is taxed by the IRS. This means the profit and losses are not filed with your business but are taxed through your personal return.

2) Partnerships:

Here the IRS treats your LLC like a standard partnership. The profit and the losses go through to the company and then to the owner which means that everybody pays taxes on their share of profits and losses.

3) LLC Corporation:

In this option, companies’ profits and losses are not individually distributed among the owners. Creditors cannot come at your personal assets to pay these debts.

The benefit here is that LLCs do not have to pay separate federal taxes which allows them to avoid double-taxation that the corporations have to deal with by paying taxes on profits which are kind of taxed again when the owner pays personal income tax, which is totally insane!

So save yourself from this double taxation by choosing LLC.

Fewer Complications:

People are attracted to Limited Liability Companies because they have to deal less with all the complications when starting their business.

LLCs are quite flexible as they require less documentation than usual corporations which means that signing up for an LLC is less time-consuming. They are really easy to maintain and are easily formed.

They are not as strict as other corporations which means they don’t restrict you on the number of owners or they won’t restrict you to see how the profits are divided among these owners.

Business Loans:

After the formation of your LLC and once your business has built a credit history, you will have the advantage of getting business loans.

You should always keep searching for loans that suit your business. For example, if you have a women-owned business then you should look for women-based loans.

You Gain Customer’s Trust:

By building your business with LLC, you gain people’s trust.

LLC is a known business structure rather than a sole proprietorship or partnership. By including LLC in your business you increase your business credibility as people will know that your business is reliable.

Downsides of an LLC

- Total Fee Is a Little High:

The notable drawback of an LLC could be its pricing. It is quite high compared to sole proprietorship or a partnership.

You have to pay the annual fee which largely depends upon your state. The amount can be as high as $750 so you need to think about the expenses you are going to deal with when choosing LLC.

The formation procedure is also quite expensive if compared to a sole proprietorship and a partnership. The formation fee also depends upon your state, it can be as low as $40 and it can go as high as $500.

- Investors usually don’t prefer LLCs:

Looking for investors which can boost your business?

Well, it would be highly unusual for an investor to invest in an LLC rather than a big corporation.

LLC members cannot fulfill their personal tax until the company transmits their K-1 form and due to this particular reason investors do not invest as they don’t want to deal with these complications.

LLC Laws Varies By State

The formation of an LLC is pretty easy but are you confused with state choices?

Cannot decide which state would suit your business? Well, it is not as confusing as you think it is.

People have usually heard that some states are quite friendly with laws for example;

In Delaware, the biggest advantage of forming an LLC is that Delaware has its own court for business matters (Chancery Courts). Having a court just for dealing with business matters helps businessmen resolve their legal encounters quickly as taking a legal matter into a general court would take months or years to resolve.

Nevada is quite famous for its business laws. Nevada doesn’t stop you from anonymous LLC membership. It allows you to release as little personal information as you want to which benefits your privacy.

Another advantage of forming an LLC in Nevada is that it does not have any business income tax, capital tax, or state corporate tax.

Wyoming is another state which offers a unique advantage, its annual fee is the lowest compared to all the other states.

With all these great advantages, everyone decides on creating an LLC in these states which eventually is a downside if you are not living in these states. Let me tell you why:

If you are starting a small business then never register in these states due to their friendly laws. You’ll have to register as a foreign LLC which will eventually cost you more as you’ll be paying for two filing and maintenance fees.

It would be wise if you start your business in your own state and pay for just one filing and maintenance fee.

Classification of LLCs

1) Local LLC:

The LLC which has been handling the business in the state where it was formed is known as Local LLC. This is the most widely used LLC.

2) Foreign LLC:

When you decide to open up your business to other states then you need to register as a foreign LLC. After opening up your business to other states, you’ll have to pay a double maintenance fee.

3) Professional LLC:

Professional LLC carries out special services like legal practice. The formation of a Professional LLC is simple. The members of LLC need to have state licenses so they can express their qualifications.

4) Series LLC:

Series LLC is a little complicated and right now you can only form Series LLC in seventeen states (Alabama, Delaware, Washington D.C, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Montana, Nevada, North Dakota, Oklahoma, Tennessee, Texas, Utah, and Wisconsin.

In this LLC, many small businesses are protected by one head LLC and every small business is safeguarded from the liabilities of other businesses.

Steps To Form a Limited Liability Company

The formation of an LLC is quite simple and you don’t need to scratch your head to understand it. I’ll be listing down FIVE steps that will help you start your LLC in your state.

If you are too busy to start your LLC, you can always hire a service provider which will easily form your LLC. ZenBusiness and Legalzoom are the most experienced and well-renowned LLC service providers.

1. Pick a Name!

This might be the easiest task in the formation of your LLC and maybe the most interesting one.

You’ll have to pick a name that is distinctive from all the registered names in your state. There are many websites that will help you evaluate a unique name for your LLC.

2. Find an LLC Registered Agent:

What is an LLC registered agent? An LLC agent will gain all your legal documents on behalf of your LLC. All your vital business relations will be operated by your agent so you do not miss anything. Your agent acts as a messenger between yourself and your company.

There are some particular states that allow you to be your own registered agent but that is quite tough as you have to be available during business hours and you have to put your personal address in the LLCs track record. So, you can also find some reliable registered agent services.

3. Importance of LLC Operating Agreement:

First of all, what is an operating agreement?

It highlights your company’s standards and operating rules. If your company has more than one member then creating an operating agreement is vital. It defines the responsibilities of all the members included in your Limited Liability Company.

It showcases how the income being generated will be distributed among all the members which will avoid any disturbance regarding money.

An operating agreement should include:

- The identity and the specific role of each member

- Division of company’s income

- Total rights and voting power of each member

- Actions needed to replace a member

- Disciplinary rules in a meeting

- Creating boundaries on transferring and selling of shares

4. File Your Certificate of Formation

A certificate of Formation is the legal document you will file to officially enter an LLC. It is also referred to as the Article of Organization.

There are many online platforms like ZenBusiness which offer methods to complete this process quickly.

5. Get Yourself an EIN!

EIN stands for Employer Identification Number. This number is used by the IRS to identify businesses. It is like a social security number required by your LLC for many purposes like opening a bank account, filing company taxes, etc.

Annual Report:

This does not lie in the category “Formation of LLC” but you must know this when you have created an LLC.

Annual reports are demanded by your state to stay informed about the changes in your company and to update any new information.

The report includes the company’s name, a specific type of your LLC (Local or Foreign), and the owner’s address; these will be updated every year. The cost of an annual report varies from State to State.

Is LLC the Best Choice?

I would recommend LLCs to people who are starting new businesses like Amazon PL or YouTube channels. The reason is that LLC protects your personal assets, saves you from all the paperwork, and provides tax flexibility. Before starting an LLC you must give importance to every single point I mentioned and then choose an LLC if it adapts to your business.

You can either form an LLC by yourself or hire a company to do all the paperwork for you. In both ways, you can manage to reduce to cost of forming an LLC in your State by doing your best.

This is everything you need to know about a Limited Liability Company. Keep in touch with us about other Characteristics of LLC.

Aisha Noreen is an owner of a small business with more than 9 years of experience in the marketing industry. With the wisdom of an old soul, she always seeks innovation and mind-blowing ROI techniques. Her unique approach helped many small businesses thrive and she can surprise you in many ways as well. Believe it or not, her energy, passion, and creativity are contagious enough to transform your business and take it to another level.